Why have Alts in a portfolio?

Alternative assets offer investors the ability to diversify away from traditional assets such as stocks, bonds and cash.

- Diversification allows a lower correlation to traditional assets and provides an effective hedge to downside risk and volatility in publicly traded capital markets;

- Alternative assets supply investors with access to a broader range of investment strategies, which can further enhance returns and limit volatility.

Alternative assets are typically illiquid, with investment horizons spanning from one year all the way to eight years+. However, investors are more than compensated for the risk and illiquid nature, as returns tend to be superior on a risk-adjusted basis.

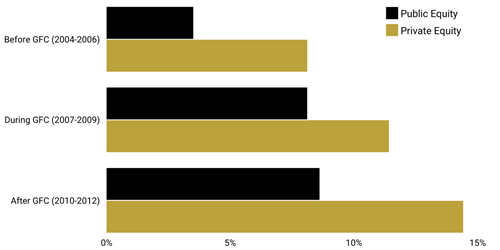

Private vs Public Equity through the cycle

Source: Capital Dynamics, Cambridge Associates for Private Equity IRR data, Bloomberg for Public Equity Index (MSCI World TR)

As can be seen in the chart above, before and after the Global Financial Crisis, Private Equity outperformed publicly listed equities. This outperformance can be attributed to a larger investment universe than public markets. The existence of a larger pool of companies, chased by fewer investors does help manager skill. Furthermore, alternative assets can include market neutral or hedge fund strategies, that can generate positive returns even when the economy is in a downturn or recession.

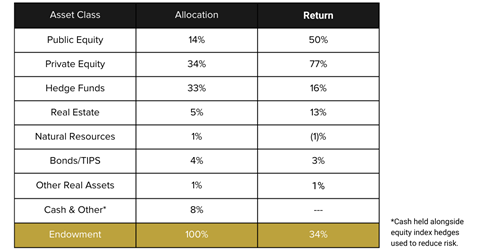

What are large institutional & endowment managers doing in Alternatives?

The Harvard Endowment Fund, one of the most experienced and respected endowment Funds globally, is a good case study. Founded in 1974, and with $53.2b in Funds Under Management, the Fund acts as an important income source to fund the university's operations and initiatives. The Funds distribution accounts for a third of the university's operation budget. Advantageous to these types of funds, the long-dated investment period enables them to hold a higher percentage of illiquid assets, such as alternative assets.

As of 30 June 2021, the Harvard Endowment Fund held 67% of their assets in Private Equity or Hedge Funds, and has managed to generate over 11% per annum since its founding (see image below). Similarly, the Future Fund in Australia have allocated 46.5% of their overall portfolio to alternative assets. The Fund has produced 9.2% per annum over the last 10 years, compared with its benchmark of 6.6%.

With the public markets down across the past year, alternatives are playing a significant role in mitigating downside risk and improving returns.

The Harvard Endowment Fund (as at June 2021)

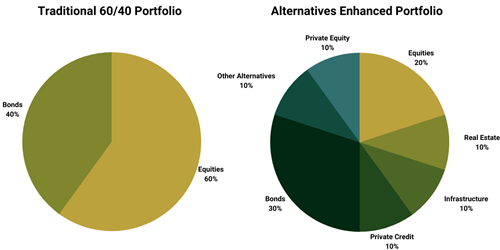

How should investors go about adding alternatives to their portfolio?

Optimising your risk-adjusted returns by reducing exposure to listed equities and public debt can be achieved by an allocation to alternative assets. When comparing the larger institutional investors, larger allocations of alternative assets can limit downside risk and provide outperformance over the long-term.

We can see from below, it is relatively easy to transition a traditional asset allocation and incorporate greater alternative assets, but also retain a high level of liquidity. The ultimate asset allocation will come down to personal preference situation and risk tolerance, and is best determined in consultation with your advisor.

Partners Private Pty Ltd is a wholly owned subsidiary of Partners Wealth Group Pty Ltd ABN 17 140 105 077, Australian Financial Services Licence No. 483842. All information in this email is general in nature and is not intended to be advice. It does not take into account your financial circumstances, goals and objectives. Before acting, you should consider its appropriateness having regard to your own circumstances. For more information visit partnersprivate.com.au